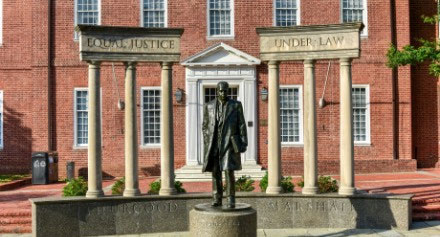

Preserving and protecting client rights in Maryland since 1946.

meet our attorneysCase Studies

Latest News

-

Miller, Miller & Canby Announces Five Attorneys Named as 2024 Super Lawyers in the State of Maryland

Miller, Miller & Canby is pleased to announce our attorneys who have been named to the list of Super Lawyers in the state of Maryland for 2024. Attorneys Donna...read more →

-

Miller, Miller & Canby Named Among 2024 Best Law Firms®

Best Lawyers has publicly announced the fourteenth edition of the Best Law Firms® rankings; Miller, Miller & Canby is pleased to announce the firm has once...read more →

-

Eight Miller, Miller & Canby Attorneys Recognized as Best Lawyers in America® for 2024

Miller, Miller & Canby is pleased to announce eight firm attorneys have been recognized as Best Lawyers in America.® for 2024. Joseph (Joe) Suntum, Joel...read more →

-

To TbyE, or not to TbyE: that is the question…

Should spouses hold limited liability company membership interests as tenants by the entirety? We recently advised a married couple on the formation of a...read more →

-

Upstream Gifting: Leveraging Today’s Higher Estate Tax Exemptions to Decrease Capital Gains Tax

Traditionally, wealth is passed down to younger generations - parents giving assets to their children and grandchildren. However, an interesting (and...read more →

-

Miller, Miller & Canby Welcomes Business and Tax Attorney Peter Randolph to Firm

Expansive Law Practice Broadens Landscape of Firm’s Business and Tax Practice Group Miller, Miller & Canby is pleased to announce that Peter Randolph,...read more →

Our Clients Matter

We prove it every day with:

- Tireless Advocacy

- Creative Problem Solving

- Client Communication

- Meticulous Attention To Detail

- High Quality, Efficient Work

- Collaboration Among Attorneys And Practice Areas

more about our firm

Subscribe to our Legal News & Notes Newsletter!

Receive quarterly emails with the latest legal news and firm highlights directly to your inbox. SUBSCRIBE